III

Insurance Institute Of India

The Insurance Institute of India is known as Federation of Insurance Institutes (J.C. Setalvad Memorial) was established in the year 1955 in Mumbai .Its main aim is to promote Insurance Education in INDIA .

Institute qualifications are held in esteem both by the regulator and the insurance industry. In its role as an Insurance education and training provider I.I.I. is closely associated with all the segments of the insurance industry which includes Insurance regulatory authority of India (IRDA), public and private sector insurance companies.

LICENTIATE EXAMINATION

This is essentially an introductory course dealing with the two compulsory papers i.e. Principles of Insurance (IC 01) and Practice of Insurance (IC 02) (Life and Non-Life) and one more paper as optional from professional exam curriculum.

ASSOCIATESHIP EXAMINATION

At this level, students may have option to choose subjects either Life or Non-Life or both combined. The scheme of study provides knowledge of chosen subject. However, candidates will have to get familiar with the practical aspects related to these subjects.

FELLOWSHIP EXAMINATION

This is the highest level and involves advanced studies of specified areas.

The Insurance Institute of India is known as Federation of Insurance Institutes (J.C. Setalvad Memorial) was established in the year 1955 in Mumbai .Its main aim is to promote Insurance Education in INDIA .

Institute qualifications are held in esteem both by the regulator and the insurance industry. In its role as an Insurance education and training provider I.I.I. is closely associated with all the segments of the insurance industry which includes Insurance regulatory authority of India (IRDA), public and private sector insurance companies.

CREDIT POINT SYSTEM OF EXAMINATION

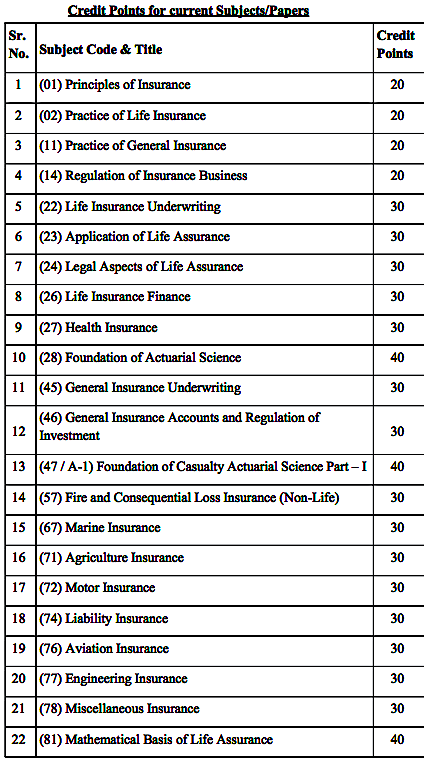

Each subject of study is assigned credit points as given in Annexure. The credit points are assigned, keeping in view, the level of examination and the difficulty level of the subject.

The above system will allow flexibility to the candidates to choose subjects of his/her choice from the available subjects and accumulate credit points. Candidates shall be allowed to appear only for a maximum 6 papers in one examination.

However, certain subjects will be compulsory i.e. if the candidate does not pass the compulsory subjects, in spite of accumulating credit points, he/she will not be granted Licentiate Certificate, Associateship and/or Fellowship Diploma. It is necessary to pass the Licentiate Examination before registration for the compulsory subjects of the Associateship. Similarly, Candidates who have passed Associateship examination only will be allowed to register for the compulsory subjects at the Fellowship level.

Following are the minimum credit points to be accumulated by a candidate for passing the Examinations.

Licentiate Certificate – 60 credit points

Associateship Diploma – 250 credit points(including the credit points at Licentiate level)

Fellowship Diploma – 490 credit points ( including the credit points at Licentiate and Associateship levels).

The subjects and combined credit points for passing Licentiate, Associateship and Fellowship examinations are as under.

A. At Licentiate Examination:

i) Principles of Insurance (IC – 01) (20 Credit Points)

AND

ii) Practice of Life Insurance (IC – 02) (20 Credit Points) OR Practice of General Insurance (IC – 11) (20 Credit Points) Plus (any one subject of 20/30/40 credit points) from the Table 1 on Page 2 in order to acquire 60 credit points.

B. At Associateship Examination (eligible for registration only after passing the Licentiate examination) :

i) Life Insurance Underwriting (IC – 22 for Life) (30 Credit Points) /OR General Insurance Underwriting (IC – 45 for Non-life) (30 Credit Points) AND

ii) Life Insurance Finance (IC – 26 for Life) (30 Credit Points) /OR General Insurance Accounts Preparation and Regulation of Investment (IC – 46 for Non-life) (30 Credit Points) Plus other subjects from the Table 1 on Page 2 in order to acquire 250 credit points (including 60 Credit Points at the Licentiate level).

C. At Fellowship Examination (eligible for registration only after qualifying for the Associateship Examination) :

One Compulsory Actuarial subject (i.e. any one Subject from the following)

i) Foundation of Actuarial Science ( (Life) (IC – 28) (40 Credit Points) OR

ii) Foundation of Casualty Actuarial Science Part ± I (IC – 47) (Non-Life) (40 Credit Points) OR

iii) Mathematical Basis of Life Assurance, (IC – 81) ( (Life) (40 Credit Points) OR

iv) Foundation of Casualty Actuarial Science Part ±II (Non-Life) (IC-84) (40 Credit Points) OR

v) Actuarial Aspects of Product Development (IC – 92) ( (Life) (40 Credit Points) (Candidates are allowed to appear for more than one compulsory subjects (within the overall 6 papers in an examination) to acquire more credit points at the Fellowship examination.)

Plus other subjects from the Table 1 on Page 2 to acquire 490 credit points (including 250 credit points at the Associateship level) to pass the Fellowship Qualification.

Other subjects/papers and its credits for qualifying Licentiate, Associateship and Fellowship examination are: