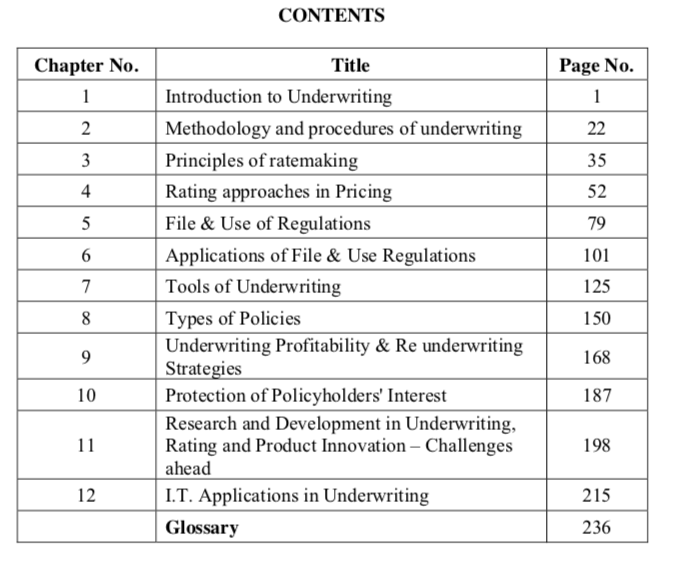

The course covers the Principles and Practice of underwriting in all classes of non- life insurance.

Specifically, the course explains the meaning, objectives and process of underwriting, describes the tools of underwriting and different methods of rate making and examines the impact of IRDA Regulations on issues of rating, underwriting, policyholders’ protection etc. Finally the course includes Research and Development and I.T. Applications in underwriting which reflect value additions to the course. Although the course covers the syllabus prescribed for the examination, it is desirable that candidates should read additional material such as text books, office manuals and operating instructions and insurance magazines etc. This will enrich their knowledge of the subject. The candidates are also recommended to collect and study specimen forms used in offices (e.g. Proposal, Policy, Claim forms and other forms relevant to the subject). This will provide a practical basis for their studies. The candidate may also avail of Oral Tuition Service wherever arranged by The Associated Institutes and the Postal Tuition Service provided by the Institute. These supplementary aids will help the student to improve their performance in the examination. The course should also prove useful to the general reader who desires to have knowledge of the subject covered.